1. Market Overview

- Size and Growth: The Australian tyre market is substantial, driven by the growing automotive industry, transport sector, and increasing demand for replacement tyres. Although Australia has seen a decline in local manufacturing of tyres (with the last major factory closing in 2010), it remains a key market for global tyre manufacturers.

- Imported Tyres: A large portion of the tyres sold in Australia are imported from countries such as China, Japan, Thailand, and the United States and Europe. Major global tyre brands like Michelin, Bridgestone, Pirelli, Goodyear, and Continental have a strong presence in Australia.

- Demand Segments: Passenger vehicles account for the largest share of tyre demand, followed by commercial vehicles, including trucks and buses, as well as specialty tyres for mining, agriculture, and construction industries.

- Industry at a glance: 5.1 Bn Industry, $230.2 profit, 4.5% annual growth, 2040 retail outlets.

2. Major Players

- Bridgestone Australia: One of the largest tyre suppliers in Australia, offering a range of tyres for passenger vehicles, commercial trucks, and industrial applications. Bridgestone has been involved in local tyre retailing and service networks.

- Goodyear & Dunlop Tyres: This company operates through a combination of imported tyres and local distribution, servicing both consumer and commercial needs.

- Michelin Australia: Another major player known for high-quality tyres and a strong presence in both the passenger car and commercial vehicle segments.

- Continental Tyres: Continental focuses on both consumer and specialized industrial markets, such as mining and agriculture.

3. Distribution Channels

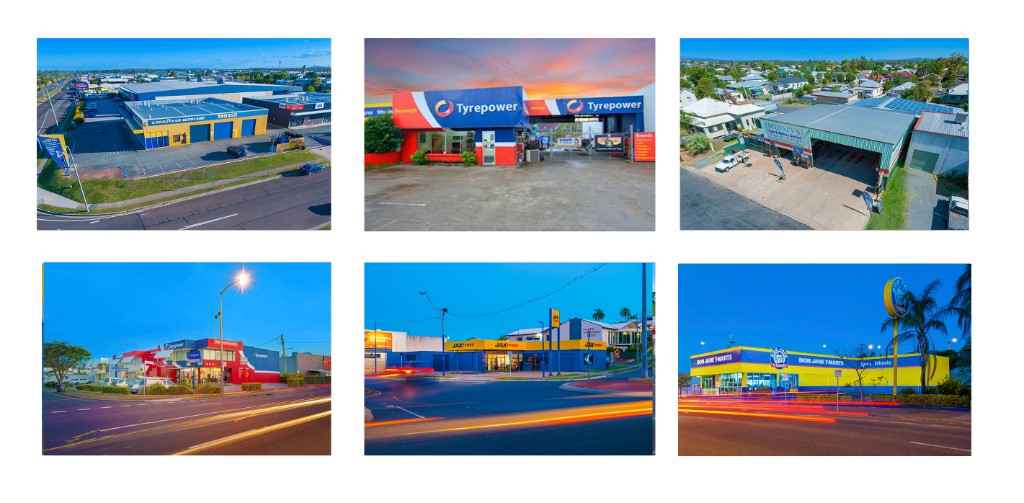

- Retailers: Tyre retailers in Australia range from large chains like Tyrepower, My Car, JAX Tyres, Bob Jane T-Marts, Goodyear Auto Care, Dunlop Super Dealers . These retailers offer sales, fitting, and balancing service. And minor brands such as Tyre Plus, Tyres & More, Hankook Master Dealers, Kumho Platinum Dealers.Beaurepaires has excited the industry.

- Online Sales: E-commerce has grown as consumers look for convenience and potentially lower prices. Retailers and manufacturers often have their online stores, and third-party platforms also sell tyres. The major on-line platforms are Tyresales & Tyroola, retail groups have their own platforms also. It is estimated the on-line sale represent 10% of the market.

4. Trends and Innovations

- Sustainability: Tyre recycling and sustainable practices are gaining prominence in the industry. Australia's growing awareness of environmental issues has led to policies around tyre disposal and recycling. Programs like Tyre Stewardship Australia (TSA) work to improve the collection and recycling of used tyres.

- Electric Vehicles (EVs): With the rise of electric vehicles, tyre manufacturers are innovating to meet the specific needs of EVs, such as improved rolling resistance, durability, and lower road noise. Australia’s EV market is still emerging, but it’s expected to drive changes in tyre demand. These vehicles are heavier than their petrol counterpart and seem to go have a more rapid tyre wear.

5. Challenges

- Competition and Price Sensitivity: The Australian tyre market is highly competitive, with a mix of premium, mid-range, and budget tyres. Many customers are price-conscious, which drives the demand for cheaper imports, particularly from China.

- Regulations: Tyre manufacturers and importers in Australia must comply with stringent safety and environmental regulations, including the Australian Design Rules (ADR) for vehicle safety standards.

- Tyre Disposal and Recycling: Australia faces significant challenges in managing the disposal of waste tyres. An estimated 50 million tyres are discarded each year, and many end up in landfills or illegal stockpiles. The government and industry are working to improve tyre recycling rates and reduce environmental impact.

6. Tyre Recycling and Circular Economy

- Tyre recycling is a critical focus area in Australia. Tyres can be recycled into various products such as road base materials, playground surfaces, and fuel for energy recovery. The industry is also looking at innovations in "tyre-derived products" (TDP) that support a circular economy model, where tyres are reused in new forms rather than disposed of as waste.

7. Economic Impact

- The tyre industry contributes significantly to Australia's economy through sales, employment in retail and distribution networks, and the service sector. Additionally, industries like mining, agriculture, and construction rely heavily on specialized tyres, further boosting demand for durable and performance-oriented tyre products.

Conclusion

The tyre industry in Australia is a 5.1 Bn industry, the marked by strong competition, a reliance on imports, evolving consumer demand, and increasing attention to environmental sustainability. With the rise of new technologies, including electric vehicles and advances in tyre materials, the industry is expected to see continued growth and transformation in the coming years.