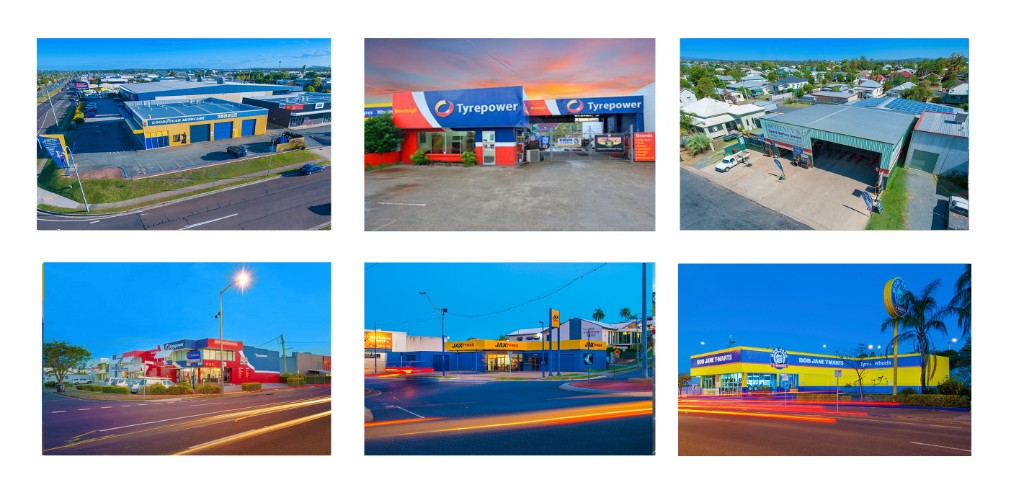

Appraising a retail tyre shop (such as Tyrepower, Bob Jane, Bridgestone, or Goodyear Auto Care) involves considering several key financial and operational factors to assess whether the investment will yield a 40% return on total investment that banks and buyers accountants are looking for. Below is a breakdown of the key aspects you need to evaluate, including goodwill, plant & equipment, onboarding fees, and other costs:

1. Initial Investment Components

- Franchise Fees: The upfront cost to buy into the franchise system (typically includes rights to use the brand, access to a customer base, and operational support). Research the franchise fees for each brand.

- Training Costs: These are the costs of the franchise’s required training programs for staff and owners to ensure operational consistency.

- Legal Fees: Due diligence, contract review, and other legal expenses during the business acquisition or franchise onboarding process.

- Stamp Duty: Depending on the location, stamp duty may be payable on the purchase of business assets.

- Bank Guarantees: Some franchises or landlords may require a bank guarantee, which could be a cash deposit or a credit facility.

- Goodwill: The premium paid for purchasing an established business. It often reflects the brand's reputation, customer loyalty, and location.

- Plant & Equipment: The cost of machinery, tire-fitting tools, hoists, alignment machines, computers, and other physical assets. Consider the depreciation and maintenance expenses of these assets.

2. Revenue Projections

- Brand Power: Evaluate the customer recognition, trust, and market reach of each brand. For example, Bridgestone and Goodyear may have stronger global reputations, but local brands like Tyrepower or Bob Jane could be dominant regionally.

- Sales Volume: Consider the franchise’s historical revenue data, average ticket size (number of tires sold, complementary services like alignment, balancing, and maintenance), and seasonal demand for tires.

- Market Position: Analyze the local competition, pricing strategy, and potential for customer loyalty based on brand appeal and pricing competitiveness.

3. Cost of Goods Sold (COGS) & Operating Expenses

- Tire Supply Costs: Franchises often negotiate tyre supply agreements. Evaluate the terms, discounts, and minimum purchase requirements for each brand.

- Franchise Royalties: Ongoing fees that must be paid to the franchisor, typically a percentage of gross sales.

- Rent/Lease: Location is critical for tire shops, and lease costs could vary significantly based on the location’s foot traffic and accessibility.

- Labor Costs: Staff wages, training, and benefits. Factor in whether the franchise has requirements for staffing levels or specialized technicians.

- Excited fees: Its is all important to calculate any exit fees associated with a franchise before entering the group.

4. Break-even Analysis

- Total Investment: Add together all the above costs (franchise fee, goodwill, equipment, legal fees, etc.).

- Expected Revenue: Estimate based on the historical performance of similar franchises in comparable locations.

- Fixed & Variable Costs: Include rent, labor, utilities, franchise royalties, etc.

- Break-even Point: Calculate when the business is expected to cover both fixed and variable costs before beginning to generate a profit.

5. Return on Investment (ROI)

The ROI formula is:

ROI=Net ProfitTotal Investment×100ROI=Total InvestmentNet Profit×100

- Net Profit: Projected based on revenue minus all operating costs, COGS, and taxes.

- Total Investment: This includes all capital outlays mentioned (goodwill, onboarding fees, equipment, etc.).

- For a 40% return, you will need to forecast whether the projected net profit in a given time frame (often over 1–5 years) will exceed 40% of the total investment. This involves stress-testing revenue assumptions and looking at different scenarios of growth and profitability.

6. Risk Assessment

- Franchise Support: Evaluate the quality of ongoing franchisor support (marketing, customer service, technical assistance, etc.) to help boost profitability.

- Local Economic Conditions: Assess how local market trends (e.g., car ownership rates, economic growth, infrastructure development) could impact demand for tyre services.

- Operational Flexibility: Some franchises allow for diversification into other auto services (e.g., vehicle maintenance, battery sales, etc.), which could enhance revenue streams.

Example of ROI Calculation

If the total initial investment is $500,000, you would need a net profit of $200,000 annually to achieve a 40% ROI:

Net Profit Target=Total Investment×0.40=500,000×0.40=200,000Net Profit Target=Total Investment×0.40=500,000×0.40=200,000

Assume projected annual sales are $1 million, and operating costs (including COGS, rent, labor, etc.) are $800,000, the net profit would be $200,000, meeting the 40% ROI.

7. Final Considerations

- Compare franchises based on both historical financial performance and support services. Brands with higher franchisor support and lower upfront fees could provide a better ROI.

- Ensure your appraisal includes realistic growth projections and sensitivity analysis (what happens if sales fall 10% or costs rise).

By carefully analyzing these components and creating a financial model, you can assess which brand offers the best potential for a 40% return on investment.